Hi all,

Over the last few years I’ve

been fortunate enough to have my short stories published in various anthologies

in both Ireland and the US, including my own collection, The Eleventh Hour. But as

some of these anthologies were compiled for the love of writing I didn’t give

much thought to the financial side of matters. Back in 2013 circumstances

changed when Gentry Publishing, New York, offered me a contract for my first

novel I, Vladimir.

So my journey began and in

doing so I had to learn what an ITIN was, and obtain one from the United States

Internal Revenue Service. Being a non-residential, non-US citizen, the thought

of the IRS brought cold sweats and it was one of those tasks I was quite

willing to put off. By August it was time to bite the bullet and get it done.

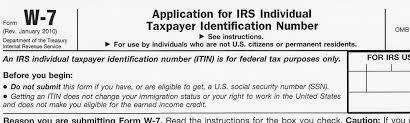

An ITIN stands for

Individual Taxpayer Identification Number. It is a United States tax processing

number issued by the Internal Revenue Service for non-residential, non-US

citizens, who are either employed or will be paid by a company registered in

the United States.

If you are publishing

through a US company, whether Traditional, Indie, or any of the self-publishing

services, it would be in your best interest to obtain an ITIN. The reason being

is by law, all companies have to withhold a percentage of your royalties for

tax purposes (30%), and you could then also be liable for tax within your own

country too. By registering with the IRS and obtaining an ITIN you become tax

exempt in the United States as long as your citizenship and residential status

remains unchanged.

Reading up on how to get an

ITIN seemed very daunting, hence another reason I kept putting it off, but in

the end I found it a lot more straight forward than I’d first imagined – so

I’ll try and keep it simple…

Firstly – Letter.

You will need a

signed headed letter from your publisher or agent stating that you have a

contract with them. If you are self-publishing, Amazon have one on their

site which you download and print off. Here.

Secondly - Passport.

Ireland has an agreement

with the US where you do not have to post your passport, all you need is a

letter of authentication from your passport office. You take your passport

along to your local passport office, for a charge (€40 approx) they photocopy

it and hand you back the photocopy and a stamped letter confirming all the

details are correct and that you are indeed whom you claim to be. If you are

not an Irish citizen, check with your own passport office to see if there is an

agreement in place, otherwise I think you have no option but to send your passport.

But I have to say that all documents were returned to me safely.

Thirdly – Application Forms.

You can download the

forms directly from the IRS website. There are two to look at, the first which

I strongly recommend you read in full is the instruction guide

Instrustions For Form W - 7 and the second is the application itself Application Form W - 7 which to be honest is pretty

straight forward. Like with all forms, just read through it carefully and take

your time.

When you have all documents,

do not send in part or incomplete, send by post to:

Department of Treasury,

Internal Revenue Service,

PO Box 149342

Austin, TX 78714-9342

United States of America.

At the time of writing this

all the information given was correct and what I personally had used. I

obtained my ITIN on my first attempt, I have read of others that have taken

three or more goes.

All I can say is take your time and make sure you have all the necessary documents and have filled everything in.

All I can say is take your time and make sure you have all the necessary documents and have filled everything in.

May I wish you all the best

in your writing career and in your application for your ITIN,

Daniel Kaye x

The tax man is not aleays so bad...

ReplyDeleteVery true, Julian...

ReplyDeleteVery helpful, Daniel. Thank you for posting.

ReplyDelete